Private Equity in 401(k) plans: Boon or a big nothing burger?

As I am sitting in my pool on a Sunday evening, I decided to read the Executive Order (EO) signed by President Trump on August 8th.

Yes, as an ERISA nerd, this is how I relax in my pool.

You can read the EO yourself, if you would like, by CLICKING HERE.

Most of the articles that are coming out in the financial publications are fairly skeptical about Private Equity being allowed in 401(k) plans.

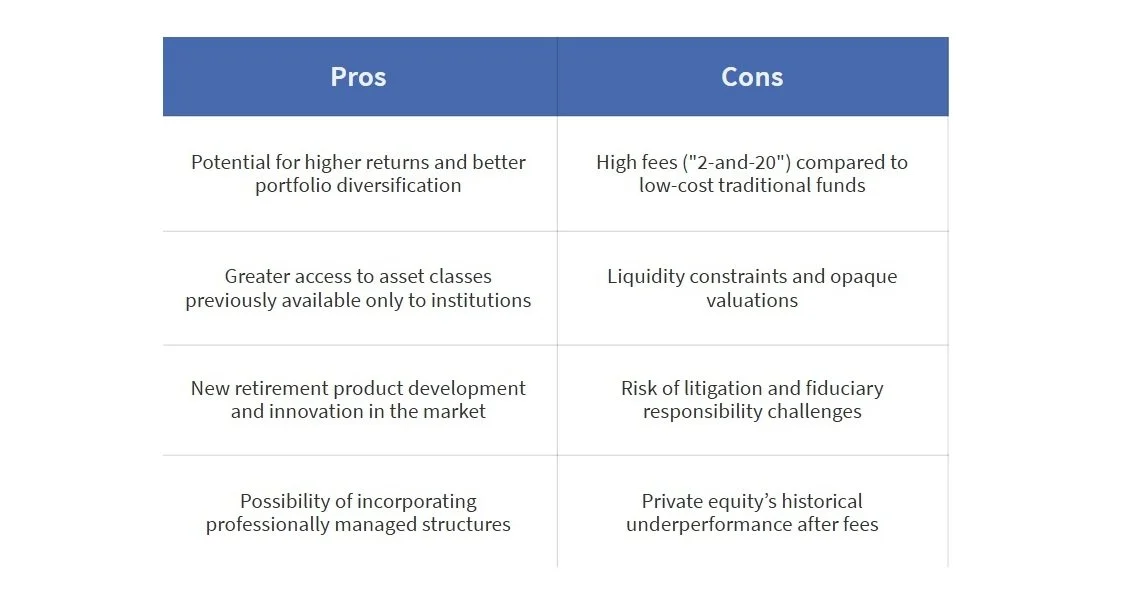

Here is the generalized list of the pros and cons about private equity:

Summary Table

I’m here take a contrarian view that the EO is really a big “nothing burger”.

At least for now.

And here’s why:

The EO order signed does not say that the DOL should allow Private Equity in 401(k) plans (and digital assets, commodities, real estate, etc which are also listed in the EO).

The EO states that the DOL should look into how to make it easier for these assets to be included in Asset Allocation Funds in 401(k) plans.

My interpretation is that the EO is looking to allow for private equity, real estate, digital assets, etc as part of Target Date Funds and Managed Accounts.

Not a separate asset class that a participant could invest 100% of their 401(k) balance into.

When I am reading the opinions of those (for and against) in the current trade publications, it’s as if they think that there will be an available private equity fund as part of the core lineup.

This executive order does not do that.

It asks the DOL to co-ordinate with other agencies (like the SEC) to allow individuals to be able have these assets are part of an asset allocation fund.

I think the co-ordination with the SEC is the more interesting part of this order, as currently, only “accredited investors” are supposed to be buying private equity.

It’s as if the EO will be used to have the SEC re-evaluate the criteria of “who” is really allowed to invest in private equity.

And I think that would be an awesome outcome.

Particularly because of what has become of the stock “market” since I have been an adviser since 1997.

No one talks about the large shrinkage of publicly traded companies from 1997.

According to one article, the number of US publicly traded companies decreased from 6500 to 4700 from 1997. I have also seen articles that state the number went from about 8,000 companies to below 4,000.

Regardless of what the actual number is, the fact remains, there are far less publicly traded companies now than there were in 1997.

Many companies are choosing to remain “private” or go public only to go “private” later.

Fewer publicly traded companies means fewer options for non-accredited investors.

Allowing investors, accredited or not, to more broadly invest in public and private markets should be considered a good thing.

Especially if you are a financial adviser.

Your clients will need your help and expertise even more to navigate this new frontier.

So, I applaud the EO in directing the DOL to co-ordinate with the SEC on “who” should have access.

I believe 401(k) participants should have access to private equity in their plans as a separate option, not just as part of an asset allocation fund.

I believe that participants should not be limited by an over protective government that limits access because they don’t think the average American is smart enough to make smart financial decisions.

And, there are already protections in place in the 401(k) industry.

Every 401(k) plan needs to have an ERISA Fiduciary making the decisions on what to include in their fund lineup.

Why limit the options they choose?

Every financial professional charging for advice to a 401(k) participant needs to comply with the ERISA fiduciary standards.

I say 401(k) participants should be able to choose if they just want public companies or if they want to invest in private companies as well.

I believe they should know the risks associated with this asset class, no differently than they should know the risk of putting their money in PIMCO Total Return (which seems to be in everyone’s 401(k) plan.

Unfortunately, the EO signed last week, does not even come close to allowing this.

So, sadly, I think there is a lot of discussion and debate going on what will eventually be seen as a big old “nothing burger”.

And speaking of burgers, I need to get out of the pool and grill some for my family.