Five-Part Test vs. Biden's New Fiduciary Rule: What’s Supposed to Change and Why It Matters

If you’re a financial professional working with 401(k) participants or IRA clients, you need to know this: The Department of Labor (DOL) has been trying to overhaul the definition of who qualifies as an ERISA fiduciary.

That means the rules for when you're considered an ERISA Fiduciary (and what you must do if you are) could be changing in a big way!

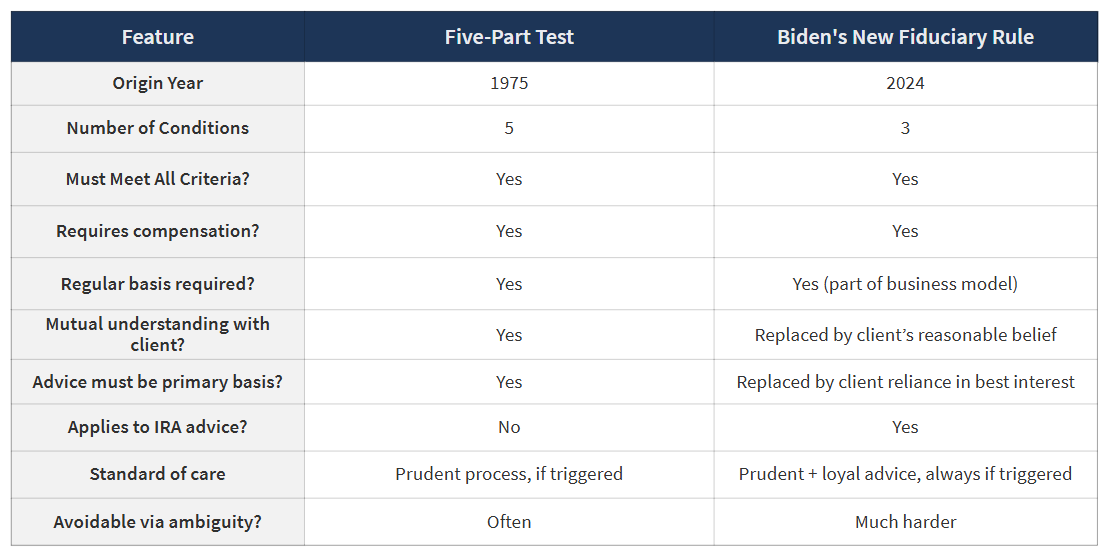

Since 1975, the DOL has relied on “The Five-Part Test”, to determine ERISA fiduciary status for those providing non-discretionary investment advice.

But the Biden Administration’s new Retirement Security Rule replaces that with a broader and simpler framework aimed at expanding fiduciary protections to more investors — especially IRA holders. This rule was supposed to go into effect on September 22nd, 2024.

The changes have been challenged in two different courts and have subsequently been “stayed” (paused) by the courts. We should know shortly what the Trump administration intends to do about the Biden changes as they have asked for an extension until Jun 16, 2025 (which has passed a few weeks ago).

In this blog, I want to break down the key differences of the changes and what they mean for you if they ever do go into effect.

📜 The Five-Part Test: Still in Effect (as the Biden changes are stayed).

The Five-Part Test applies to professionals who give investment advice without discretion (your clients trade their own accounts) and determines ERISA fiduciary status if the advisor meets all five of the following conditions:

Receives compensation (direct or indirect) for advice,

Gives advice on a regular basis,

Maintains a mutual understanding with the client that advice is being provided,

Offers advice that serves as a primary basis for the client's decision, and

Provides advice that is individualized based on the client’s personal circumstances.

If any one of these parts is not satisfied — say you don’t get paid, or it’s a one-time interaction — you are not considered an ERISA fiduciary under current rules.

This test has been criticized for being too narrow, ambiguous, and easy to avoid.

Many financial “professionals” have relied on the "gray areas" — especially points 2 through 4 — to claim they're offering guidance, suggestions or education, and not fiduciary advice – to avoid the heightened requirements of being an ERISA Fiduciary.

In fact, many firms will not allow their advisers to be ERISA Fiduciaries under any circumstances.

🔄 The Biden Administration’s New Rule (currently paused)

The Biden DOL is replacing the Five-Part Test with two new pathways to fiduciary status under ERISA Section 321(a)(ii) – (non-discretionary advice to an ERISA covered participant).

1. Automatic Fiduciary Status (C1(ii))

If you acknowledge in writing, verbally, or via public materials (e.g. ADV, website, etc) that you are acting as a fiduciary, then you are one — no test required!

2. New Three-Part Functional Test (C1(i))

You’re an ERISA fiduciary if all three of the following are true:

You regularly make investment recommendations as part of your business;

Your advice is individualized based on the client’s financial circumstances, goals, etc.;

It is reasonable to believe the client will rely on your advice as being in their best interest.

This new test is broader, less ambiguous, and applies to more professionals — including those advising on IRAs, which were largely exempt before.

In effect, it captures many who previously fell outside the Five-Part Test simply by tweaking the language around frequency, intent, and scope of advice.

This test is no longer just for investment advisers. It’s also for FINRA brokers and insurance professionals who sell products to IRA clients.

And it is being vehemently opposed by the insurance industry who will have issues with high commission products if it ever goes into effect.

💡 Why the Change?

The DOL believes that millions of Americans — especially IRA holders — are currently receiving advice that isn't subject to fiduciary protections, even though it significantly impacts their retirement.

By replacing the Five-Part Test, the DOL hopes to:

● Level the playing field for all retirement investors

● Reduce conflicts of interest, especially in rollover recommendations

● Ensure anyone acting like a trusted advisor is legally obligated to act like one

The Biden rule is intentionally more inclusive.

It no longer depends on vague mutual understandings or whether advice is the "primary" basis for a decision — it focuses on actual client reliance and the advisor’s role in providing personalized recommendations.

🎯 What This Means for You

If you:

● Recommend 401(k) rollovers to IRAs

● Advise IRA clients on investing, switching funds, or reallocating assets

● Use language in your ADV, marketing, or emails that sounds like fiduciary advice

Then under the new rules, you are almost certainly considered an ERISA fiduciary — and must comply with the full set of obligations, including:

● Delivering a written fiduciary acknowledgment

● Meeting impartial conduct standards (care + loyalty)

● Using a prohibited transaction exemption (PTE 2020-02 or 84-24)

🛡️ Bottom Line

The Five-Part Test gave financial professionals wiggle room.

The new rule removes the guesswork!

Whether you’re an RIA, broker-dealer, or insurance agent, the fiduciary net is looking to expand — and you need to be ready if the courts don’t shoot it down.

Want a simple way to stay compliant under the new rules?

Take the ERISA Best Practices Course (EBPC) — we walk you through exactly what to do, what to say, and how to protect yourself.

Learn more about our 6 hour CE course by checking out https://www.erisanerd.com/erisa-best-practices-ce-course

And use Coupon Code “IAR100” to take $100 off!

-Kevin T Clark, RF™

CEO of PlanConfidence and The ERISA Nerd!