ERISA Best Practice CE Course

6 hours of IAR CE “Ethics” -AND - 6.5 hours of CFP credit

Working with “held-away” assets?

You’re may be an ERISA Fiduciary—Even If You Don’t Realize It!

The Risks:

New rules to comply with from the DOL that differ from being an IAR Fiduciary

Clients now have access to the Federal Courts (which they usually don’t)

Personal liability for non-compliance

The Solution:

A Step-by-Step Course That Shows You What to Do—And Gives You the Tools to Do It

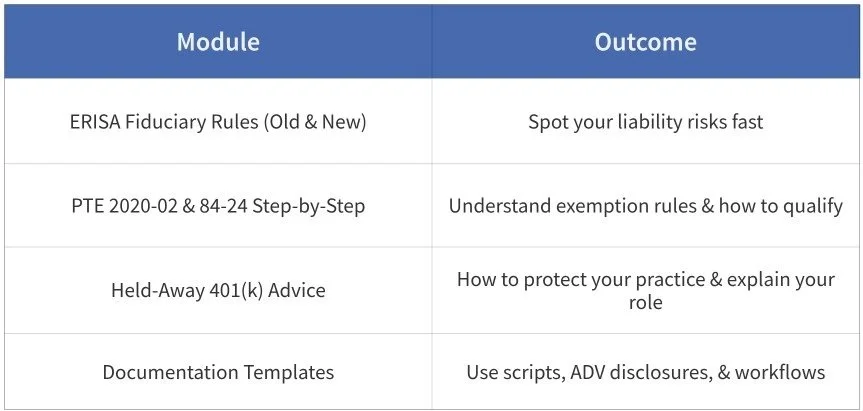

This on-demand course teaches financial professionals how to navigate the complex fiduciary rules surrounding 401(k) and IRA advice. Built around real-world practices, the course covers ERISA fiduciary status triggers, compliance with PTE 2020-02 and 84-24, and includes practical steps to document rollover and held-away advice properly. Designed for IARs, RIAs, insurance agents, and broker-dealer reps, the course also qualifies for CFP and IAR CE credit—and includes optional access to fully editable compliance templates.

Understand ERISA Triggers

Master PTE 2020-02 & 84-24

Use Our Plug-and-Play Templates

Don’t Reinvent the Wheel—Get the Docs That Keep You Safe

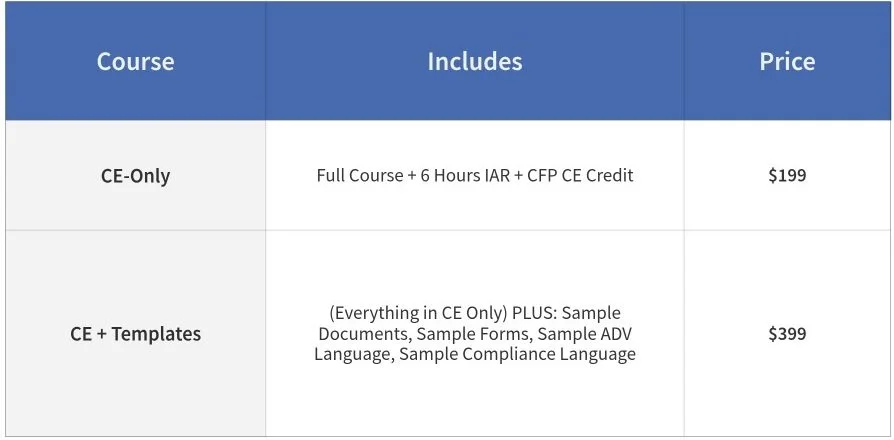

Legal templates alone are worth over $1500+ You get them for just $200 more.

Choose the Package That Fits Your Practice

Learn From a Real ERISA Practitioner, Not a Theory-Heavy Lawyer

Kevin Clark is a Registered Fiduciary with over 25 years of real-world experience helping advisors stay compliant and confident. As founder of Plan Confidence and creator of this course, he’s worked with hundreds of firms to simplify complex ERISA rules into clear, actionable steps. His practical, no-fluff approach has made him a trusted guide for advisors who want to get it right.

Why DID He Build This Course?

Kevin created this course to fill a gap he saw every day—advisors being held to fiduciary standards without clear guidance on how to stay compliant. After decades of helping firms navigate ERISA rules, he realized most professionals weren’t getting practical, actionable training. This course was built to change that—to simplify complex regulations, reduce risk, and give advisors the tools they need to do their job with confidence.

Ready to Stay Compliant and Confident?

Complete the course in just 6 hours and walk away with the clarity and CE credit you need to protect your practice. Whether you need to comply with PTE 2020‑02, 84‑24, or simply want a bulletproof rollover process—you’ll get expert instruction, CE credit, and optional templates that save you hours.

✓ Qualifies for CFP and IAR CE credit

✓ Instant, self-paced access

✓ $100 off with code IAR100 – Limited Time