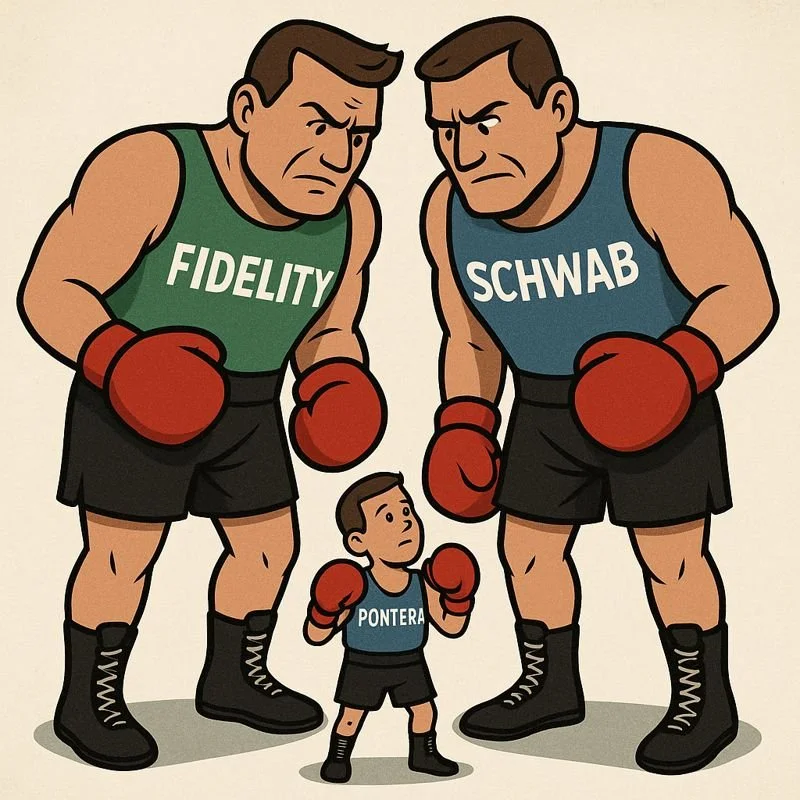

Fidelity & Schwab vs. Pontera — the “WHY”!

In October I blogged about Fidelity blocking Pontera’s access to its platform. (Fidelity V Pontera - CLICK HERE to read it).

Since I wrote that blog, it has been reported that Schwab has also started blocking Pontera users. (I have no firsthand knowledge of this, as we don’t have a lot of clients with 401(k) plans at Schwab).

Much has been written about this David V Goliath battle.

But one thing that has been missing from all the articles is the “WHY” this is occurring.

What’s at stake?

WHY would Fidelity and Schwab go out of their way to prevent financial advisers from implementing advice for hard-working Americans?

What reason could possibly be so justifiable for them to do this?

Well, that’s simple.

They have trillions of reasons to do so.

Over Thirteen Trillion reasons specifically!

See, there are over 13,000,000,000,000 dollars invested in defined contribution plans (401k, 403b, 457 & TSP)[1].

Schwab and Fidelity are custodians for (literally) trillions of these dollars.

When a client is working, that money is near impossible to move to another IRA or employer plan. So, as long as the participant keeps working, the money will stay put.

The firms don’t have to work very hard to “earn” the participants’ loyalty because they are “hand cuffed” by the law that prevents 401(k) participants from moving their money.

But as soon as the participant switches jobs, becomes eligible for an In-Service withdrawal, or retires, the money can be moved!

The participant is no longer “hand cuffed” to a custodian they had no say in using.

The participant has free will and can work with any financial firm they choose.

And that’s what is scaring the pants off Fidelity and Schwab!

Fidelity and Schwab dominate the retirement marketplace.

They custody trillions in 401(k) assets, and they generate substantial revenue from recordkeeping arrangements, managed accounts and proprietary funds (especially Target Date Funds).

Giving advisers direct trading access, through Pontera or anyone else, reduces their control over the asset flows inside those plans. (I have not met an adviser that doesn’t think that they can’t outperform a Target Date Fund).

And here is the irony, Fidelity and Schwab could potentially make more money if an adviser is allowed to manage their clients “held-away” 401(k) accounts.

Let’s assume that many of the “studies” are correct and a financial adviser can add 300 basis points of alpha versus a participant left on their own.

That’s 3% compounded growth, year after year.[2]

On top of 13 trillion dollars, that can compound quickly.

Assuming that Fidelity and Schwab are earning basis points via the standard revenue sharing agreements, this could be huge for them because the “pie” they are drawing their fees off of would be getting larger.

Instead, Fidelity and Schwab seem content in ensuring that the pie stays smaller, as long as only their ingredients (funds) are the ones used in it!

This is very short-sighted and will affect them in the long run by keeping the pie smaller than it could be.

Another problem for Fidelity and Schwab:

There is another major problem that financial advisers pose for both custodians.

Although the problem is bigger for Fidelity.

Fidelity and Schwab fear a pre-existing relationship with a financial adviser almost certainly means the money will be “rolled over” to an IRA as soon as it can be (separation from service or In Service Distribution).

And for the most part, this is 100% true and is a big concern for both custodians.

Although it is self-inflected!

Locking advisers out of the “held-way” accounts affects Fidelity more.

Currently, only “independent” advisers are working with “held-away” 401(k) accounts.

The largest firms out there (think Edward Jones, LPL, Merril Lynch, etc) will not let their advisers put any advice in writing when it comes to a “held-away” 401(k) account. (They have very legitimate reasons for this, ones that my company PlanConfidence has solved, but that is a blog for a future date).

Charles Schwab is the largest custodian for Registered Investment Advisers (RIAs).

In fact, they work with about 4 times more advisers than Fidelity and custody more than twice the amount of RIA assets.

So, when an independent adviser recommends a rollover, there is a good chance that the money comes from a Fidelity 401(k) plan and is going into a Schwab IRA.

A loss for Fidelity and a gain for Schwab.

It makes sense why Fidelity is worried about independent advisers and are blocking them from managing their “held-away” accounts through Pontera as they have more to lose.

Now, there is a simple fix for all of this!

But one that will require a paradigm shift from short-term thinking to a long-term vision.

A shift so large that only a bold and visionary leader will be able to pull off.

And it’s so simple!

Fidelity and Schwab should embrace ALL the independent advisers in the country!

They shouldn’t fear them.

They should make it easy to implement advice from any financial firm and not make it harder.

They should also allow an “outside” adviser the ability to “fee” the assets of the plan (no differently than they allow for fees coming from an IRA).

If an adviser had the ability to easily implement their advice and collect their fee on “held-away” 401(k) assets, “rollovers” would slow a trickle!

The only reason an adviser is highly motivated to move the money from a 401(k) plan in the first place, is due to the restrictions (trading and fee collection) that are currently in place by 401(k) custodians like Fidelity and Schwab.

Get rid of the restrictions and everyone wins:

1) The custodians will win because their “slice of the pie” will dramatically grow as participants earn more with proper allocation advice. And the pie would grow dramatically due to rollovers slowing down. Assets growing at a faster rate and staying in the plan longer would be a tremendous boost to Fidelity’s bottom line.

2) The holistic advisers would win as they would be able to manage all of their client assets. Not just the ones under their custody.

3) And most importantly, the participants will win because they will now actually have a choice to work with any adviser in the country on managing their 401(k) account.

This is our vision at Plan Confidence: “Every 401(k) participant getting professional advice from an adviser of their choosing”!

And I am pathologically optimistic enough to believe that this will happen.

And once it does, our industry can retire the word “held-away” once and for all!

I just hope, for everyone’s sake, that this vision becomes a reality sooner, rather than later.

12/16/2025: UPDATE: Since writing this blog a Pontera spokesperson provided an update: “A credentials reset is fundamentally different from blocking consumers’ digital access to their accounts en masse or threatening to permanently revoke that access. One is a familiar security protocol. Companies routinely ask users to reset logins and passwords. It’s a common housekeeping security measure that we support. Fidelity's actions are punitive to the consumer and is in no way routine or common. This is not the same thing. Fidelity stands alone in its actions. And we should all be concerned by those actions.”